Getting the most out of your prescription drug benefits

By: Mark Pabst

The Medicare Part D and prescription drug information below is educational only. Check your benefit documents for details about what is specifically covered under your plan.

Your prescription drug benefits are one of the most important parts of your Medicare coverage. Getting the right prescriptions, at the right time and at the right price, is a key part of staying healthy.

So, what’s the secret to making the most of your Medicare prescription drug benefits? One step is to find out if you qualify for extra assistance to pay for your medications. Other steps include knowing the medications you take, the pharmacies where you can get your prescriptions filled and a bit about the specifics of your drug coverage. Here are a few tips to get you started.

Step one: Know your medications

Make a list of all prescription medications you take currently and be sure to update the list when one of your doctors adds a prescription or tells you to stop taking a particular drug. To make sure your list is accurate, take the information from any pill bottles you have, noting not only the name of the medication but also the strength and how often you take it. And of course, don’t forget to include what condition the medication is meant to treat.

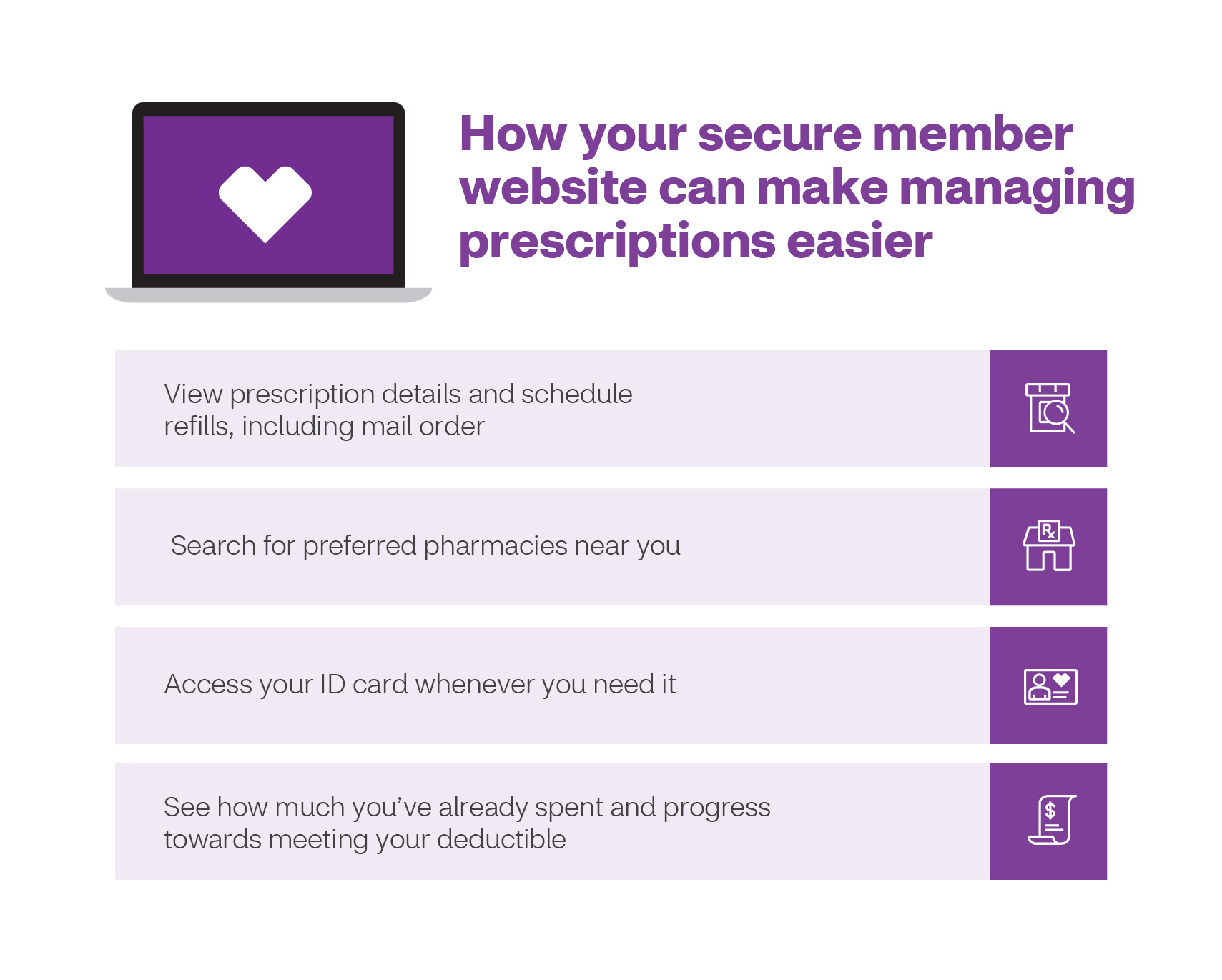

While you can simply keep this information on a piece of paper, it’s often more convenient and almost always more effective to keep a digital copy of your list. You can even enter this information into your secure member website, and some plans allow you to keep your list via a mobile app. If you prefer, you can speak over the telephone with a representative who will work with you to get your medication information into the Aetna® system.

You should also share the list with someone you trust, and make sure a copy is accessible in case of emergencies. And don’t forget to share your list with your doctors, as they may not necessarily know what you have been prescribed by another physician.

When speaking with your physicians, ask if a generic version of your medication is available. Generic medications are as effective as their brand-name versions and may offer big savings. Members concerned about reaching the coverage gap may help delay or avoid it altogether by using generic medications. Some plans may require that you begin with the generic version of a drug and then progress to other medications only if your condition does not respond to the first medication you’re given.

You should also look at your formulary, a list of drugs covered by your plan and the level of coverage provided. Your formulary organizes drugs by different tiers. Generally, the lower the tier the less you pay. You can go online to find your formulary and use the drug search tool to look up the cost of a drug directly.

Step two: Know your pharmacies

Another way to save money is to use preferred pharmacies, if offered by your plan. Your plan may have thousands of preferred pharmacies, and getting your medications from these pharmacies will save you money versus getting them from standard pharmacies.

You will find preferred pharmacies at Aetna’s Medicare website and on your member website. There you can even find the closest preferred and standard pharmacies to your location. If you’re still not sure which pharmacies in your area are preferred pharmacies, call the number on your member ID card.

Don’t forget that there are sometimes changes to which pharmacies are preferred, and occasionally in-network pharmacies become out of network. Be sure to check regularly to confirm the status of the pharmacies you use.

Step three: Know how — and how often — you’ll get your medications

Having a preferred pharmacy close by can be convenient, but it can be even more convenient to get your prescriptions delivered. *CVS Caremark® Mail Service Pharmacy and many other pharmacies deliver free of charge. Just make sure you order your prescriptions early enough, so you don’t run out of your supply of medication before your delivery arrives.

One way you can avoid running out of medication is to check if you can order a long-term supply (90- or 100-day) of the drugs you routinely take. And some medications will even cost less per dose if you choose to order a 90- or 100-day supply versus a 30- or 60-day supply.

Depending on your plan, you may also have access to medically trained support staff like case managers and pharmacists through Aetna. For example, with some Medicare Advantage (MA) plans, if you’re taking a specialty medication you will be able to speak via telephone with a specialty pharmacist. They can give you tips on:

- How and how often to take your medications

- How to minimize any side effects from your medications

- How to look for signs your medication is working

Last, but not least, keep in touch

The medications you take may change over time. There may also be developments in best practices for taking your medications, new therapies and even new ways you can save money when filling your prescriptions.

If you choose not to use your secure member website to keep up with these changes, you should still sign up to receive emails that can provide information like helpful tips for accessing your medications or new discounts available to you. You can sign up for these emails by providing your email address when you enroll in your plan. Or by speaking with a customer representative or by updating your “Profile & Preferences” section in your secure member website. Keeping in touch could not only make sure you stay educated on how to take your medications, but it could also save you time and money when it comes time to refill your prescriptions.

Aetna and CVS Pharmacy® are part of the CVS Health® family of companies.

*This pharmacy is a pharmacy in our network in 2021. CVS Caremark® Mail Service Pharmacy may also contract with other plans.

Other Pharmacies are available in our network. The formulary and/or pharmacy network may change at any time. You will receive notice when necessary. Aetna Medicare’s pharmacy network includes limited lower cost, preferred pharmacies in: Suburban Arizona, Suburban Illinois, Urban Kansas, Rural Michigan, Urban Michigan, Urban Missouri, Suburban West Virginia. The lower costs advertised in our plan materials for these pharmacies may not be available at the pharmacy you use. For up-to-date information about our network pharmacies, including whether there are any lower-cost preferred pharmacies in your area, members please call the number on your ID card, non-members please call 1-855-338-7027 (TTY: 711) or consult the online pharmacy directory. Members who get “Extra Help” are not required to fill prescriptions at preferred network pharmacies in order to get Low Income Subsidy (LIS) copays. See Evidence of Coverage for a complete description of plan benefits, exclusions, limitations and conditions of coverage. Plan features and availability may vary by service area.